Advertising

The Credit Score was created so that banks can identify the financial profile of each customer. And how is this done? According to each person's payment history.

That said, to check yours in a simple way, you have the possibility of doing it online via:

Advertising

- Serasa application;

- Serasa website;

- BoaVista website;

- Foregon website.

Continue reading below for more detailed information, which helped you in this process consultation.

How to Consult for Free?

To carry out your score analysis and find out your score is simple, you can create your account on Serasa and carry out the analysis online via the website or app. Always in a practical, fast and free way!

How many consultations can I make?

Point consultations on Serasa are unlimited and free for each user.

If you want to consult more than one CPF, you will need to create a new account with email and the requested data, or join a plan.

Advertising

How is the score analysis carried out?

Your score analysis is based on your financial history, being taking into account positive and negative factors, being them:

Positive factors

- Paid bills;

- Accounts up to date;

- Loans paid or up to date;

- Financing paid or up to date;

- Credit card bills paid or up to date.

Negative factors

- Late bills;

- Negative accounts;

- Unpaid/late loans;

- Unpaid/delayed financing;

- Divide with credit cards.

As you can see, your financial history is based on everything that involves your CPF and your day-to-day accounts, so it is extremely important to keep up to date with your accounts, whatever they may be.

How is the Score Measured?

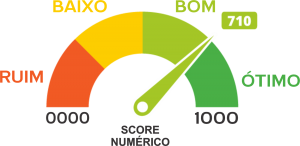

The Credit score is divided into numbers ranging from 0 to 1000. The closer to the number 1000 your score is, the better your score.

It is divided into three categories, namely:

- Low (from 01 to 399)

- Average (from 400 to 699)

- High (from 700 to 1000)

Whenever you check your score, check which category it is in.

If you liked this article and it helped you, comment below to let us know your opinion. Before you leave, we recommend that you get to know the new Nubank card that comes with a digital account.

It may seem crazy, we know, but getting a card approved and moving it, positively impacts your points and it makes a good impression on other financial institutions that you may have already sent requests to. Don't waste any more time and enjoy, check it out!